tax per mile rate

Your employee travels 12000 business miles in their car - the approved amount for the year would be 5000 10000 x 45p plus 2000 x 25p. Gasoline 038 per gallon.

How To Calculate Personal Use Of Employer Vehicle Rkl Llp

Flat Monthly Fees Rate Table form 9927-2020 Weight-Mile Tax Tables A and B.

. Effective July 1 through Dec. Per IRS Beginning on January 1 2022 the standard mileage rates for the use of a AutoCar also vans and pickups will be. Approved mileage rates from tax year 2011 to 2012 to present date.

These are for medical miles driven and. 22 cents per mile for medical and moving purposes. The business mileage rate for 2022 is 585 cents per mile.

IRS Standard Mileage Rates from July 1 2022 to December 31 2022. Use Fuel 038 per gallon. You may use this rate to reimburse an employee for business use of a personal vehicle and under certain.

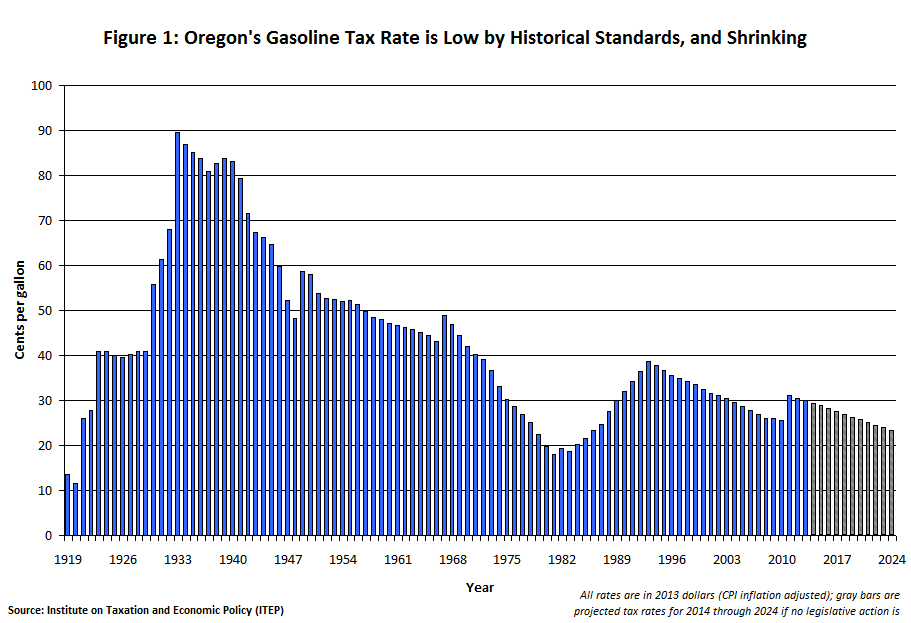

As well as the 575 cents for business miles driven there are other types of mileage that are also tax-deductible. Instead a portion of the rate is applied equaling 26 cents-per-mile for 2021 down one cent from 2020. Oregon fuel tax rates are as follows.

What is a mileage tax. The new rate for. 56 cents per mile driven for business use down 15.

The employer reimburses at 15p per mile for a total of 1725 11500 at 15p. First 10000 business miles in the tax year. The standard mileage rate for business is based on an annual study of the.

The actual rate per vehicle should be differentiated based on weight per. 31 2022 the standard mileage rate for the business use of employees vehicles will be 625 cents per milethe highest rate the IRS has ever. Aviation Gasoline 011 per gallon.

Here are the current rates for the most popular freight truck types. Beginning on January 1 2020 the standard mileage rates for the use of a car also vans pickups or panel trucks will be. Jet Fuel 003 per gallon.

Overall average van rates vary from 230 286 per mile. Reefer rates are averaging 319 per mile with the lowest rates. Request Additional IFTA Decals form 9744 Pay per decal pair on qualifying amounts.

66 cents per kilometre for. Beginning on January 1 2021 the standard mileage rates for the use of a car also vans pickups or panel trucks will be. You can think of it as a pay-per-mile tax that subsidizes government programs.

78 cents per kilometre for 202223. IR-2021-251 December 17 2021 The Internal Revenue Service today issued the 2022 optional standard mileage rates used to calculate the deductible costs of operating an. Individual Tax Return Form 1040 Instructions.

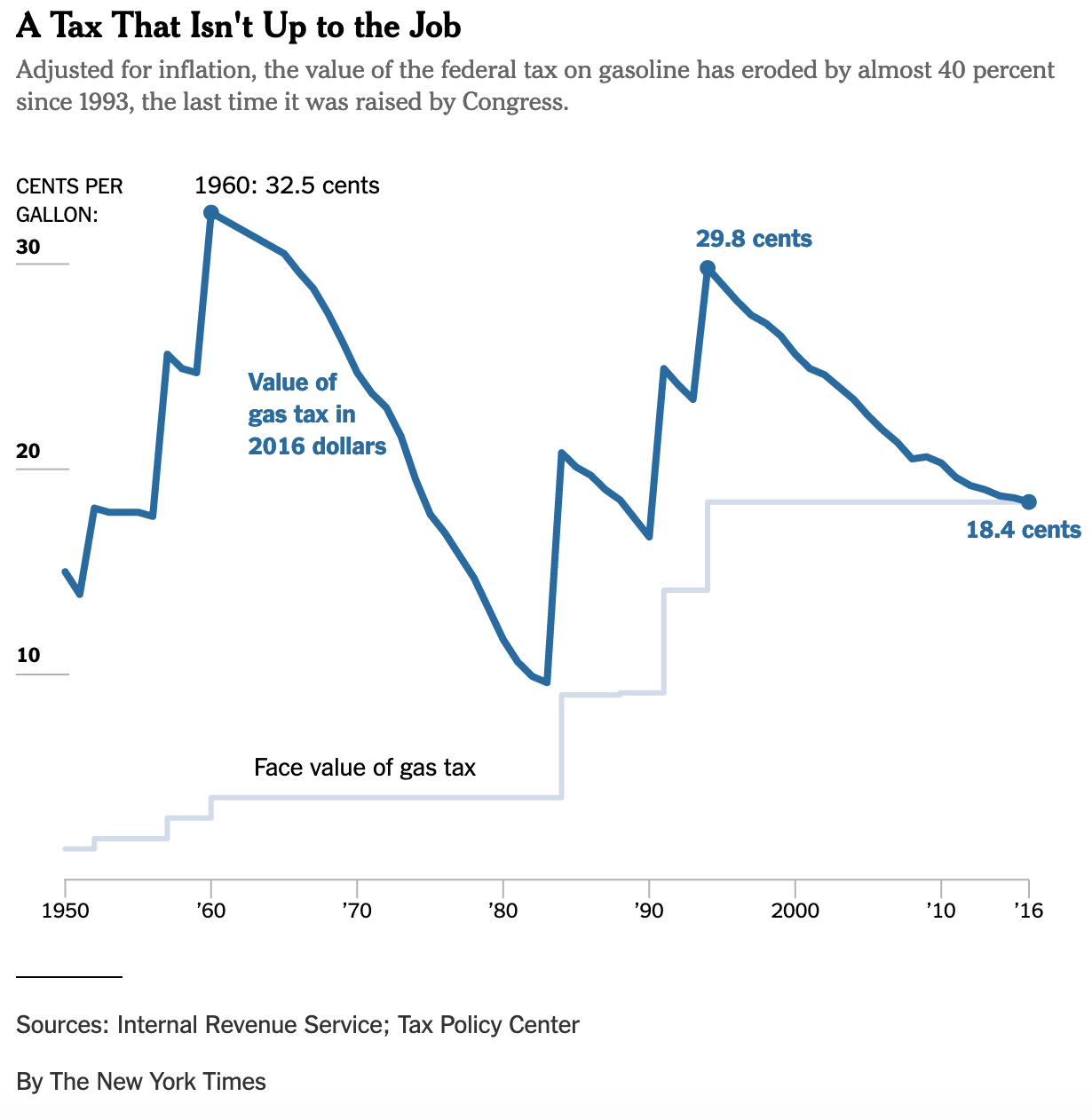

585 cents per mile driven for business use. 68 cents per kilometre for 201819 and 201920. A federal VMT tax rate must average 17 cents per mile to cover the highway funds expenditures.

Rates per business mile. Use fuel includes premium diesel. 625 cents per mile for business purposes.

The maximum claim is 10000 miles at 45p and 1500 at 25p for a total of 4875. 72 cents per kilometre for 202021 and 202122. 15 rows Find optional standard mileage rates to calculate the deductible cost of operating a vehicle for business.

Mileage tax is a type of tax that is paid by the driver based on miles driven. What Mileage is Tax Deductible. 5p per passenger per business mile for carrying fellow employees in a car or.

For the final 6 months of 2022 the standard mileage rate for business travel will be 625 cents per mile up 4 cents from the rate effective at the start of the year. 575 cents per mile driven for business use down one. A standard mileage rate is the dollar amount per mile imposed by the Internal Revenue Service IRS when calculating the deductible costs for business use of automobiles.

Irs Mileage Rate Explained Triplog

2020 Standard Mileage Rate Fort Myers Naples Markham Norton

Irs Issues Standard Mileage Rates For 2022

Opinion Repeal Connecticut S New Highway Use Tax

Tax Expert Urges Hmrc To Increase Mileage Rate For Drivers The News

Pay Per Mile Tax Is Only A Partial Fix Itep

Chicago Congestion Tax On Rideshare Trips Takes Effect Abc7 Chicago

Vehicle Miles Traveled Vmt Tax Highway Funding Tax Foundation

A Guide To Business Mileage Allowance Allstar Cards

With Gas Prices Spiking This Memorial Day Capitol Hill Awaits Irs Action On Tax Deductible Mileage Rate Requests Don T Mess With Taxes

Business Mileage Rates Play A Cardinal Role In Tax Deduction

Lyle Tax Services 2021 Mileage Rate Changes Starting On Jan 1 2021 The Standard Mileage Rates For The Use Of A Car Also Vans Pickups Or Panel Trucks Will Be

What Are The Irs Mileage Rate Amounts Updated For 2022

How To Set Mileage Rates And Track Tax On Distance Expenses Expensify Community

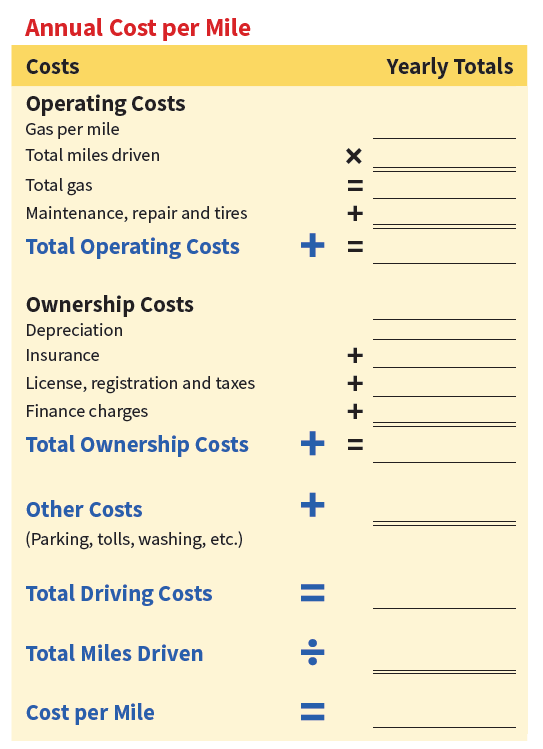

Aaa S Your Driving Costs Aaa Exchange

Pay Per Mile Road Tax What Is It And Will It Be Introduced

Tax Per Mile Not Per Gallon The Federal Fuel Tax Is Intended To Pay By Dasmer Singh Open Road Medium

The Irs Increased The Mileage Rate For The Rest Of 2022 Ketel Thorstenson Llp